Student debt is on the minds of all young dentists. According to the American Education Association (ADEA), the average debt of a student exiting dental school in 2015 was just north of $255k. In 1996, the average debt on graduation was $84,247. When adjusted for inflation, the average dental student graduated in 1996 with $127k of student debt in 2015 dollars. This means that over the last twenty years, the cost of dental school has doubled after adjustment for inflation. [You can read more about the numbers from dental economics: http://www.dentaleconomics.com/articles/print/volume-106/issue-9/macroeconomics/on-student-debt-culpability-and-the-generation-gap.html].

A couple of months ago a few threads opened on Dental Town regarding student debt and I would like to address two of them.

The first poster asked if dental school was worth $400,000. The second poster has found herself in $567,000 of student loan debt and was asking for advice regarding the management of that debt.

The cost of tuition to attend dental school has skyrocketed over the last decade. Unfortunately, many new graduates are realizing that the average general dentist’s compensation does not support the cost of the education required to enter the profession.

For what it’s worth, I believe that $300,000 is the tipping point where pursuing a career as a general dentist no longer makes financial sense for the majority of students.

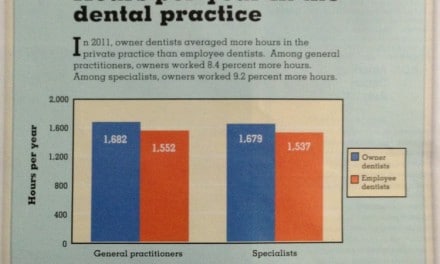

The American Dental Association (ADA) reports that the average annual income for a general dentist in 2013 has fallen to $180,000. [For a good read about dentist incomes visit: http://www.drbicuspid.com/index.aspx?sec=ser&sub=def&pag=dis&ItemID=316974]. The ADA reports that the average owner GP earned $192,000 in 2013 and the average non-owner took home about $130,000.

New graduates typically earn much less than the average income reported by the ADA, but I have yet to find a reliable survey that examined the earnings of a large number of recent graduates (those within their first five years of practice). Based on conversations I have had with other dentists and the information I’ve read on online forums like Dental Town and Student Doctor Network, combined with my own experience, I think it is safe to assume that a dentist will likely earn between $80,000 and $150,000 during their first full year of practice.

Of course, there are outliers in both directions as there are many factors that influence a new dentist’s initial compensation.

For simplicity, let’s assume that over the first five years of practice, a general dentist earns an average of $120,000 per year. That’s a salary of $10,000 per month before taxes and other necessary expenses.

A $400,000 student loan with an average interest rate of 6% on a ten-year term requires a monthly payment of $4,440.82 after taxes – this adds up to $53,289.84 per year of after-tax income.

How much you take home after taxes when making $10,000 a month depends on your own personal situation – what state do you live in? How many dependents do you support? Are you married? Do you own a home? Does your spouse earn an income? You’ll have to talk to your CPA to dig into the numbers. For simplicity, let’s assume you’re tax savvy and only lose 20% of your gross income to federal and state governments.

20% of $120,000 is $24,000…what does that mean? It means that if you have 400k in student loans after you pay taxes and service your debt, you have $42,710 left to live on and save for retirement.

Here’s the math: $120,000 – $24,000 (Taxes) – $53,289.84 (Student Loan Payments) = $42,710.16

For reference, according to PayScale, the average salary of an elementary school teacher is $43,000 plus great benefits.

Can you live on less than $45k per year? Yes, if you receive benefits from an employer, however, dentists are usually sole proprietors who have to fund their own retirement accounts and pay for their own health, life, and disability insurance policies. Add it all up and then pay for rent and all the typical utilities and it’s easy to see how a high-income professional actually lives month to month for the first decade of her career with little to nothing in the way of savings to show for her efforts. Love teeth or hate them, I doubt anyone of us went to dental school with the aspirations of living paycheck to paycheck.

A $567,000 student loan at an average interest rate of 6% on a ten-year term requires a monthly payment of $6,294.86 after taxes – that’s about $75,000 a year for ten years.

Let’s do the math again:

$120,000 – $24,000 (Taxes) – $75,000 (Student Loan Payments) = $21,000

Good luck managing that debt to income ratio without some serious financial assistance from your parents or the government.

For a lot of us, it’s too late – we’ve already paid for dental school and are now trying to manage our personal financial situations as best as we can.

In my opinion, if you have more than $300,000 in student loan debt and do not have a parent practicing dentistry that guarantees a smooth transition into ownership (maybe even at a significant discount), you need to find employment that qualifies for public service loan forgiveness (PSLF).

More on managing your debt next time.

This is an incredible analysis on the current situation with dental education and new dentists. As a new dentist myself with huge debt I am very thankful to be working in a community health center eligible for public health loan forgiveness. Having worked in corporate and private practice prior to my current situation I cannot imagine how one would be able to claw out of debt unless you were to sell your dentistry soul to the devil. Even public perception of dentists (check out recent threads on Reddit) is at an all time low. Corporate chains / HMO factory style dentistry is borderline unethical and has sadly lower the bar of our profession to the level of dental “car salesmen”. Dental insurance maximums have not increased with inflation for the last couple of decades. Non-increasing maximums coupled with the rise of CareCredit is now making it harder for the public to discern the difference between dentists and subprime mortgage lenders.

Thanks so much for the commentary Andrew – couldn’t agree with you more.

Some corporate chains and some private practitioners have lowered the bar. There are certainly unethical dentists practicing in both scenarios. Painting a broad brush stroke by saying “Corporate chains/HMO factory style dentistry is borderline unethical” is narrow-minded and destructive. Private practitioners have routinely sold themselves short in contract negotiations with 3rd party payers. Couple this with self-admitted widespread business illiteracy and the same are almost solely to blame for falling reimbursement rates. In addition, the private practitioner has largely dominated the ADA policy agenda since its inception. As the ADA drives ADPAC, any lack of cost control on tuition and loan reform from a political perspective is also due to this old guard. Dentistry will follow medicine as how the business is run for many more reasons other than loan to income ratios. New thinking, organization and action has to occur to correct this catastrophe otherwise dentistry of the future may be non existent.

Where in the world can you hire a GP for $10k per month? I’d hire five of them right now at that price. Easily, it’s 50% more than that in my area – and I’m considered rural and underserved (Northern NH) in a low cost of living region.

Tad, $500 per day is the typical per diem for a GP with less than 5 years of experience in most areas of the US. Popular locations can offer less due to competition in the job market. A job search in any major metro should confirm this.

It’s true that a dentist can be guaranteed to earn more in rural areas, however that’s not always the case.

If your office is in a rural, underserved location, there are many factors that may influence the compensation you may have to provide a GP to consider a position there including the loss of income potential for his or her spouse.

Thanks for your reply.

We’ve paid as low as $600 and as much as $1,000+ per day guaranteed. Both with upside productivity bonuses possible on top of that.

You are right about the spouse / significant other issue. That affects us. As does the desire for a more urban lifestyle, especially for younger dentists.

Chance, It’s good to see that you have spare time away from the chair to which you have been chained by your debt! Your analysis is correct, it is not worth mortgaging your future for a profession that may be in transition.

A few (many?) years ago I was talking with an oral surgeon who said that he could earn enough money working a construction job in the summer to pay for his tuition and expenses for a year. Now as an oral surgeon he could not even do that.

It’s a problem that everyone seems to recognize but few are ready to address.

Think about all the “wiz-bang” things that you had at your fingertips in dental school–CERAC machines, Cone-beam and all the other technology, all those things that enticed you to go to a specific school. That doesn’t come cheap. By and large the salaries of the professors are well below the “national average” for early career dentists, typically in the $85-100K region, although with great benefits.

While Sanders and Clinton wanted to give everyone “free college”, it would make more sense for a new high school graduate to look into a trade like plumbing or HVAC repair. The initial investment would be much less as well as the stress from the debt.

It’s glamorous to be called “Doctor”, but it doesn’t pay the bills.

Regarding “a profession in transition” you only need to look at the Pew and Kellogg foundations’ pouring millions of dollars into the “mid-level provider” model to be concerned about the future of dentists. Academic look at the concept of “teaching dental students for the profession of the future”, but ignore the profession of the present. It’s great to look ahead 50 years and project what we, as dentists will be doing, but it doesn’t address the harsh reality of the present.

While I didn’t know G.V.Black personally, I’m nearly that old, but I’m glad I’m where I am in my professional life, and not where the newly minted dentist is.

Best of luck

Dr. Tuffluv – thanks for the commentary.

It’s true that dentistry is a profession in transition and it will be interesting to see where it goes from here.

A recent article published by NPR is relevant to this post: https://whyy.org/segments/dental-school-grads-find-it-hard-to-beat-back-student-debt/